Managing a small business demands plenty of focus to details, and another crucial aspect of business managing is handling the funds. Nevertheless, its not all banks are compatible with small enterprises. Many banking companies supply top quality services that is probably not financially prudent for small businesses. However, tide bank is unique it’s a financial school that serves small enterprises, supplying bespoke financial remedies that fit them finest. In this article, we are going to have a extensive look at Tide bank and how it could improve your business business banking experience.

1. What exactly is Tide bank, and exactly how will it be Various?

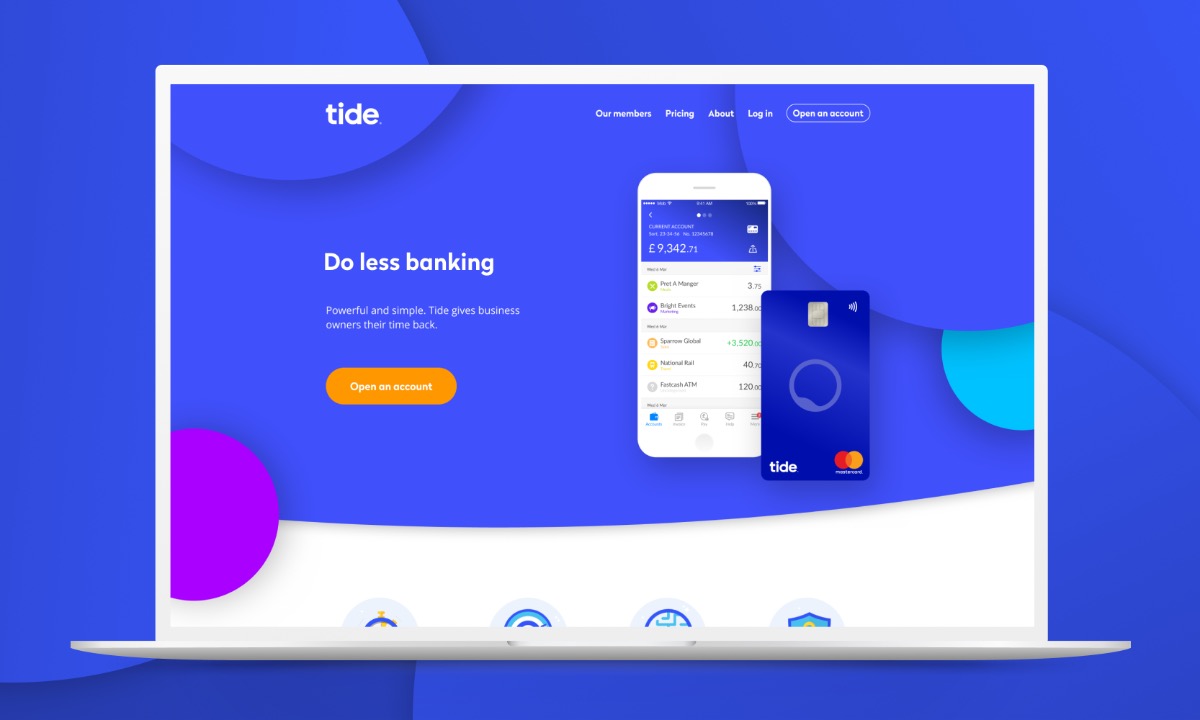

tide business account is actually a electronic digital bank built mainly for small businesses throughout the uk. Most traditional financial institutions give a one particular-sizing-satisfies-all services version that doesn’t cater to certain small business requirements. On the contrary, Tide bank recognizes and prioritizes the precise monetary demands of small business proprietors. You don’t must offer numerous papers or physically visit the bank to start a Tide account. Within a number of techniques, it is possible to wide open your account in history time, which saves you money and time.

2. Easily Control Your Business Budget

Handling business financial situation is time-taking in and might be overwhelming, specifically if you don’t use a committed monetary professional or bookkeeper. Thankfully, Tide bank provides an instinctive web-structured application that offers straightforward-to-comprehend economic reports. It is possible to view your finances, monitor your purchases, and entry additional features easily in the app. Furthermore, you get a intelligent business Mastercard without yearly service fees, so that you can easily deal with your expenditures, regardless of whether you’re on the go.

3. Track and Control Your Bills

As mentioned above, dealing with expenditures is a crucial element of smaller businesses. Fortunately with Tide bank, you can actually path your expenditures. It is possible to label expenses, set a financial budget, and keep track of your shelling out. These characteristics are helpful, especially if you’re seeking to make any expenditure slices. You may also customize it to indicate the expenses relevant to specific jobs, rendering it less difficult for income tax purposes.

4. Wise Business Financial loans

Just about the most frequent challenges small business proprietors face is funding, and accessing business personal loans might be a long and complicated procedure. Nonetheless, Tide bank offers intelligent business financial loans created to fit little business owners. You can get a loan directly from the application, and you may comprehensive the process in approximately 5 minutes. The personal loans don’t need belongings as collateral, and also the bank loan phrases are adaptable, rendering it simple to handle.

5. Why Pick Tide bank?

Tide bank needs to be your go-to bank if you’re a compact business operator. It gives you bespoke business banking solutions, helps you save money and time, and possesses an user-friendly iphone app that one could accessibility anywhere, anytime. Also, Tide bank has reasonably priced charges you can find no concealed costs, which may be a significant charge saver. Lastly, the bank is reputable and protected you are able to relax knowing your cash remains safe and secure.

In short

In conclusion, Tide bank is really a bank developed only for smaller businesses. It caters to modest business owners’ monetary needs, supplying bespoke banking alternatives, and offers an intuitive application which helps you handle your money effectively. The bank is reliable and protect, as well as the costs are inexpensive, and that means you can center on developing your business. So, head over to Tide bank’s website now, open an account, and experience trouble-free business banking.